Get the free form 403

Show details

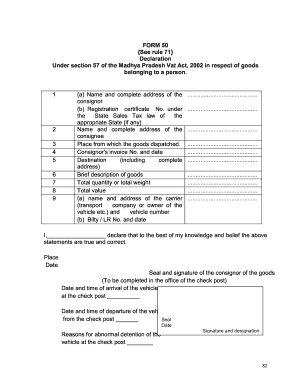

FORM 403 ORIGINAL See sub-rule 5 of rule 51 DUPLICATE TRIPLICATE Declaration under Section 68 of the Gujarat Value Added Tax Act 2003 For goods entering into the State from outside the State To The officer in charge Check post 1 Place to which goods are dispatched District 2 Place from which goods are dispatched District 3 Details of goods invoice NoDate 4 Consignee s details Name State Address Registration Certificate No Date Telephone CST Fax No. 5 Nature of Transaction 1 Inter state sale...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your form 403 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 403 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 403 online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 403 online. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

How to fill out form 403

How to fill out form 403?

01

Enter your personal information such as name, address, and contact details.

02

Indicate the purpose of the form and provide any relevant details or explanations.

03

Complete all the required sections of the form, ensuring accuracy and clarity.

04

Attach any supporting documents requested by the form's instructions.

05

Double-check all the information provided before submitting the form.

Who needs form 403?

01

Individuals who are applying for a specific license or permit.

02

Businesses or organizations seeking authorization for specific activities or operations.

03

Anyone required by a regulatory or governing body to provide specific information or documentation.

Video instructions and help with filling out and completing form 403

Instructions and Help about notification invoice form

Fill 403 form printable : Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of form 403?

Form 403 is a sales tax form used by businesses in the province of Ontario to report and remit their sales tax information to the Canada Revenue Agency. The form is used to report the amount of sales tax collected on taxable sales, and to remit the corresponding amount to the CRA.

What is form 403?

Form 403 refers to a specific document or form used by certain organizations or agencies. Without further context, it is not possible to determine the specific purpose or content of Form 403. The form number alone does not provide sufficient information to give an accurate answer. Therefore, it is important to provide more details or context to determine the exact nature of Form 403.

Who is required to file form 403?

Form 403 is not a commonly known form, and therefore there is limited information available. Based on the available information, including in some state-specific contexts, it appears that Form 403 may refer to a specific form required by certain entities or individuals for particular purposes. Without further context or information, it is not possible to determine who is required to file this form. It is recommended to consult the relevant regulatory authorities or seek professional advice to determine the specific requirements for Form 403 filing.

How to fill out form 403?

Form 403, also known as the Employer's Annual Return of Remuneration Paid (T4 Summary), is a document used by employers in Canada to report the total employment income, deductions, and remittances for their employees. Here's how you can fill out Form 403:

1. Employer and Establishment Information: Provide your business's legal name, business number (BN), and address. Include the establishment number if applicable.

2. Contact Information: Enter your name, title, telephone number, and email address.

3. Reporting Period: Indicate the start and end dates for the reporting period for which you are preparing the return.

4. Total Employees: Report the total number of employees for whom you are filing T4 slips.

5. Pension Adjustment Reversals: If you need to make any pension adjustment reversals, enter the total amount in this section.

6. Contributory Periods: Report the total number of contributory periods for your employees. Remember to exclude any employment periods exempt from contributions.

7. Total Income: Add up the employment income for all employees. This includes salaries, bonuses, commissions, tips, and other remuneration.

8. Other Income: Report any other income components provided to employees, such as taxable allowances or benefits.

9. Grossed-Up Taxable Income: If you have grossed up any taxable allowances or benefits, enter the total amount for all employees.

10. Pension Adjustment: Enter the total pension adjustment amounts for all employees.

11. Registered Retirement Saving Plan (RRSP): Indicate the total amount of RRSP contributions made by you, the employer, on behalf of your employees.

12. Employment Insurance (EI): Report the total EI premiums for all employees.

13. Canada Pension Plan (CPP): Enter the total CPP contributions made by you, the employer, for your employees.

14. Other Deductions: Include the total amount of any other deductions made from employees' income, such as union dues or provincial health plan premiums.

15. Total Remittances: Sum up all the amounts remitted for income tax, CPP, and EI.

16. Payment Type: Indicate the payment method used for remittances by checking the appropriate box.

17. Total Amount Remitted: Enter the total amount remitted for the reporting period.

18. Certification and Signature: Sign and date the form to certify its accuracy.

Once you have completed all the required sections of Form 403, retain a copy for your records and submit it to the Canada Revenue Agency (CRA) by the required due date.

What information must be reported on form 403?

Form 403 typically refers to the Annual Return of Employee Income Tax Withheld. The information that must be reported on this form includes:

1. Employer Information: This includes the employer's name, business address, employer identification number (EIN), and contact information.

2. Employee Information: For each employee, you must provide their name, Social Security number (SSN), address, and total wages paid during the year.

3. Tax Withholding Details: You need to report the total amount of federal income tax withheld from each employee's wages. This includes the amount withheld from regular wages, bonuses, tips, commissions, and any other forms of compensation subject to income tax withholding.

4. Employer Health Insurance Information: If the employer provides health insurance coverage to its employees, the cost of the coverage must be reported.

5. Retirement Plan Information: If the employer offers a retirement plan, such as a 401(k) or a pension plan, you need to report the contributions made to the plan on behalf of the employees.

6. Other Deductions: Any additional deductions, such as contributions to flexible spending accounts (FSAs), Section 125 cafeteria plans, or other pre-tax benefits, should be reported.

7. Total Tax Liability and Deposits: You must report the total tax liability for the year, which is the sum of the federal income tax withheld from employees' wages. Additionally, you should provide details of federal tax deposits made throughout the year.

It's important to note that the specific requirements for Form 403 may vary based on the country or jurisdiction. Therefore, it's advisable to refer to the instructions provided with the form or consult with a tax professional to ensure accurate reporting.

When is the deadline to file form 403 in 2023?

The deadline to file Form 403 in 2023 will depend on the specific jurisdiction or agency for which the form needs to be submitted. Form 403 is not a standard or universally recognized form, so it is necessary to provide more information about the purpose and context of the form in order to determine the precise deadline.

What is the penalty for the late filing of form 403?

Form 403 is a report filed by certain nonprofit organizations to certify their charitable solicitation activities in some states. The penalties for late filing of Form 403 vary depending on the state. Each state may have different rules and regulations regarding late filing penalties.

It is essential to check the specific regulations of the state where the organization is filing the form for accurate and up-to-date information on penalties. Some common penalties for late filing might include monetary fines, the suspension of fundraising activities, or the loss of tax-exempt status.

How can I edit form 403 from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your form 403 online into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send tax 403 form for eSignature?

To distribute your form 403 pdf, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I edit form 403 download on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign form no 403. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

Fill out your form 403 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax 403 Form is not the form you're looking for?Search for another form here.

Keywords relevant to 403 form

Related to 403 form pdf

If you believe that this page should be taken down, please follow our DMCA take down process

here

.